The case for small business investing

We’re on a mission to buy and grow small companies — targeting 20-25% investor returns.

Problem

Entrepreneurs want to build successful businesses. Investors want to invest in profitable businesses. But the research is clear — startups are statistically unsuccessful.

Solution

Instead of starting a business, we buy already profitable companies and grow them over the long haul.

Less risk. Better returns.

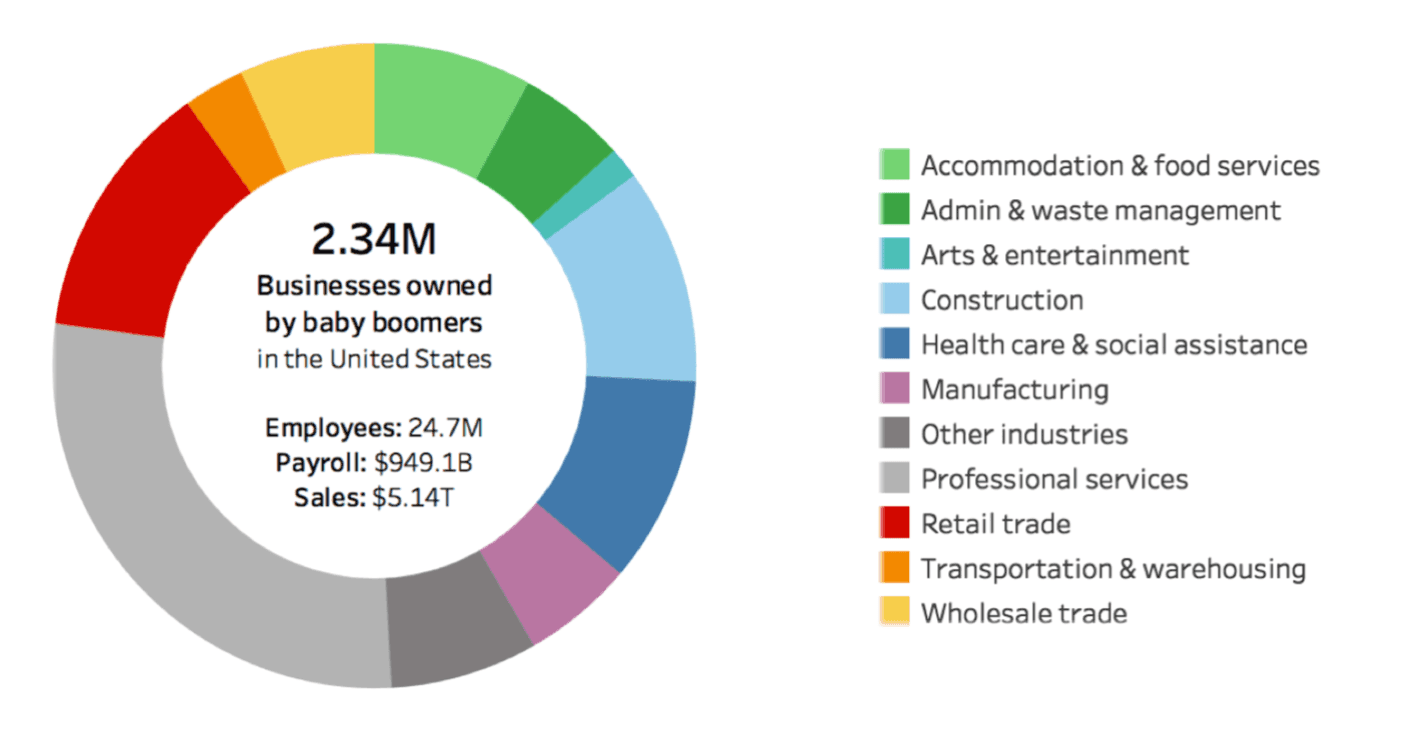

The Silver Tsunami of Retiring Business Owners

Baby boomers own more businesses than any generation in US history — 43% of small businesses. This small business tsunami creates an unprecedented buying opportunity.

Boring business is our strategy

Small businesses are under appreciated, underserved, and untapped cash flow opportunities.

We’re not in the business of gathering fees with no skin in the game. We charge zero management fees. Typically, we’re the largest single LP in our deals. So you’re not only an investor, you’re a partner. And we will only make money when you do.

Our game plan is Bill Walsh straightforward — buy great companies, recruit great players, and let the scoreboard take care of itself.